Automating Invoice Processing

How logicacode Transformed a Telecom Giant’s Workflow

In today’s fast-paced business environment, efficiency and accuracy in financial operations can make or break growth. At Logicacode, we recently partnered with a leading telecom company in the Middle East to revolutionize one of their most resource-intensive tasks: invoice processing.

The Challenge: Manual, Slow, and Error-Prone

For years, the telecom’s finance department relied on a large operations team to manually verify invoices. This meant:

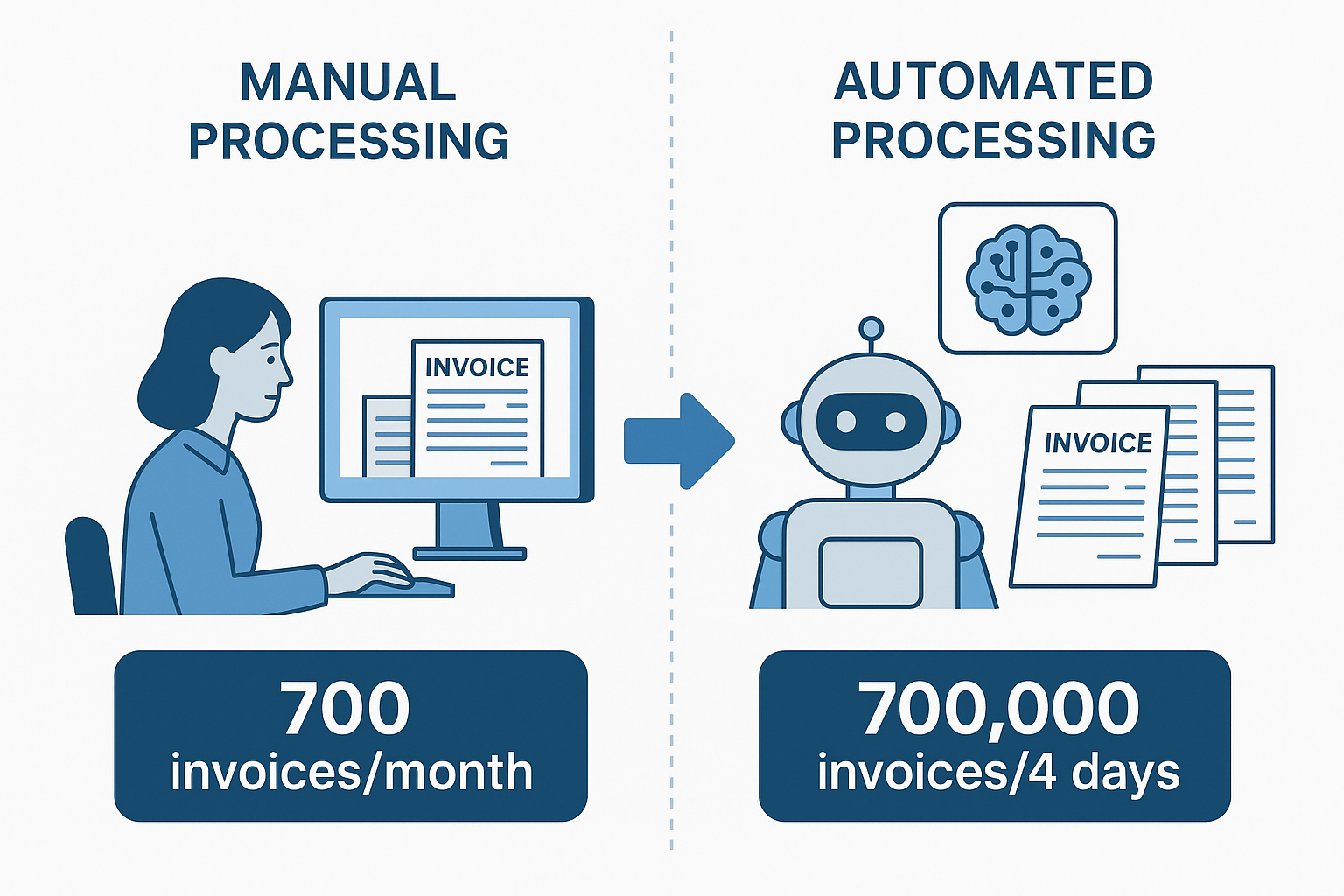

- 700 invoices processed manually in one month (by a full team)

- High risk of human errors in verification and calculation

- Limited scalability when invoice volume spiked

- A bottleneck affecting the company’s financial KPIs

With over 700,000 invoices requiring verification, the manual approach was unsustainable.

The Solution: RPA + AI Integration by logicacode

Logicacode’s team designed and deployed a Robotic Process Automation (RPA) and AI-driven verification system tailored for the client. The solution included:

- Cosmetic Verification: Ensuring invoice formats, fields, and layouts complied with the company’s financial standards.

- Information Verification: Cross-checking supplier data, invoice numbers, and dates with internal records.

- Calculation Verification: AI-driven algorithms detecting mismatches in totals, taxes, and charges.

The Results: From Weeks to Days

The impact was nothing short of transformative:

- 700,000 invoices processed in just 4 days

- Speed increase of 500x compared to manual processing

- Significant cost savings by reducing reliance on large manual teams

- Enhanced accuracy, improving compliance and financial KPIs

This shift allowed the client to reallocate their finance staff to higher-value strategic work while maintaining full confidence in invoice accuracy.

Business Impact and KPI Gains

- Efficiency: Tasks that previously took a month now completed in less than a week

- Scalability: System handles high-volume spikes without performance loss

- Accuracy: Reduced error rates lead to cleaner audits and fewer disputes

- Strategic Workforce Use: Employees focus on decision-making instead of repetitive checks

What This Means for Enterprises

This project highlights how automation and AI can unlock massive efficiency gains in finance operations, especially for enterprises dealing with high transaction volumes.

If your business is struggling with manual invoice checks, compliance risks, or slow processing cycles, automation isn’t just an upgrade — it’s a competitive necessity.